Climate change and financial risk: how economic models can help

In a series of speeches for the Bank of England, Mark Carney warned firms and investors that they must adapt to climate risks.

Sophie Heald explains how models can be used to help quantify these risks.

The last decade was the warmest ever. In recent months, we have seen the devastating effects of wildfires that swept across Australia, storms and flooding in Europe, and melting of Arctic sea ice on an unprecedented scale.

But it is not only the natural environment that will be affected by climate risks.

Technological advances and the pressure to decarbonise are driving a seismic shift in the way that we produce and use energy.

We are in the midst of a climate revolution, which poses financial and economic opportunities and risks that cannot be ignored.

Whilst there is considerable uncertainty about the scale of climate-related damages and future technological advances, scenario analysis, drawing on results from economic models, can provide valuable insights on the distribution of climate-related risks and opportunities across regions and sectors of the economy.

Vulnerability to transition risks

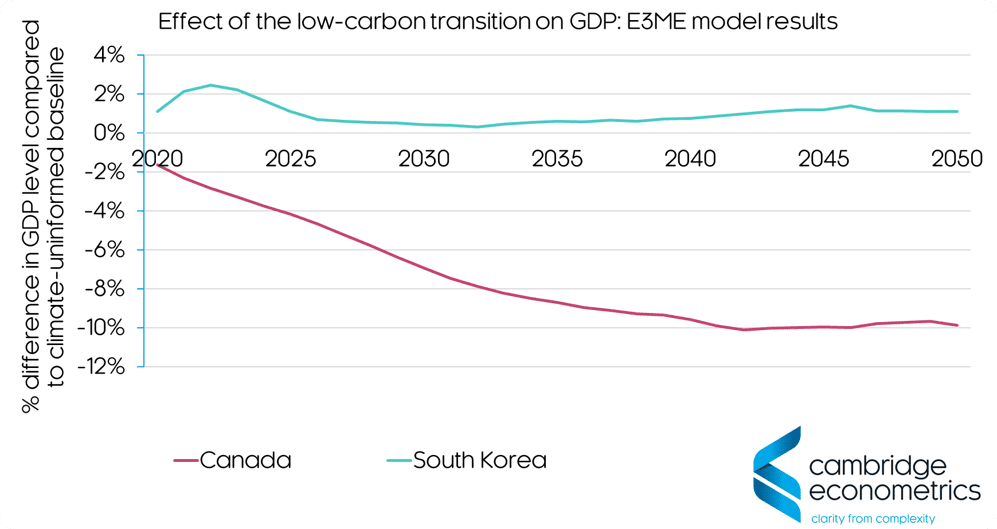

Insights from our own modelling and analysis show that vulnerability to transition risks is crucially dependent on each countries’ dependence on trade in fossil fuels and their ability to capture a part of the low-carbon technology supply chain.

Take the example of South Korea, which currently relies on imports to meet 98% of its primary energy needs.

A commitment to a low-carbon future in South Korea will drive a transition away from imported fossil fuels towards domestically produced renewable electricity, which will create benefits for the domestic economy.

Coming from a strong manufacturing base, specialising in hi-tech electronics and engineering, it is also likely that South Korea will benefit from an increase in demand for low-carbon technologies and a subsequent boost to manufacturing supply chains.

By contrast, following a global commitment to decarbonise, those regions such as Canada that produce and export oil and gas will be vulnerable to the effects of falling global demand for fossil fuels, and lower oil and gas prices.

The integrated fossil fuel supply curves within our E3ME model provide insights that show that not all oil and gas exporting regions will be affected by these transition risks in the same way.

Following a reduction in global demand for oil and gas, and a fall in price, it is those regions that are producing these fuels at highest marginal cost that will see production cut first.

And this explains why we see such high exposure to transition risks, as a result of stranded fossil fuel assets in regions such as Canada.

Models of the global economy, like E3ME, can also provide insights into the impact of the low-carbon transition across different sectors of the economy.

In addition to the direct impacts on renewable technology and fossil fuel supply industries, models can take account of how low-carbon policies, such as a carbon tax, affect industry costs (based on the carbon-intensity of manufacturing processes) and the extent to which these higher production costs are passed on to final consumers.

Modelling physical risks

We have never experienced warming of a level beyond 1°C, so how could any modelling approach possibly capture the impact on the natural environment, and the knock-on for the economy, of warming of 4°C or above?

The impact of climate tipping points, in particular, suggests that most, and potentially all, of the estimates from integrated assessment models and econometric analyses are underestimating the potential scale of impact of future warming.

Given the potentially catastrophic scale of risk, for climate economics, it is prudent to apply a precautionary principle, whereby the worst case forecast by a credible expert becomes the benchmark.

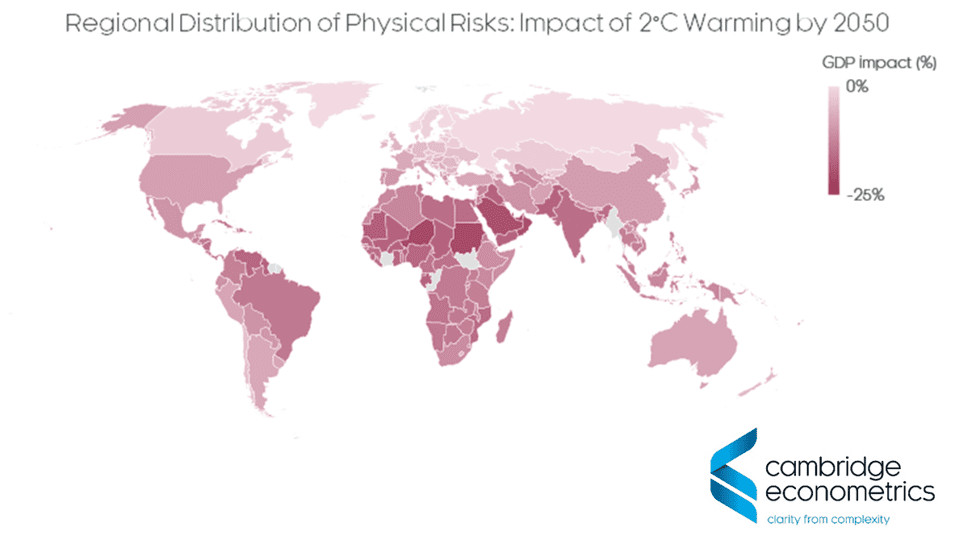

At Cambridge Econometrics, we integrate climate damages from the latest literature to assess the regional distribution of physical risks, after taking account of regional differences in warming and climate vulnerability.

In a high warming scenario that already reaches 2°C warming by 2050 (i.e. on a pathway to 4°C by 2100), our analysis suggests GDP could be up to 25% lower (by 2050) compared to a scenario with no further climatic change.

Further information

Visit our Sustainable Investment page to find out more about how we quantify climate-related financial risk.

Watch our video series below and go to the Cambridge Econometrics YouTube channel to see all our films and subscribe.