Sustainable investment: investing in a time of climate change

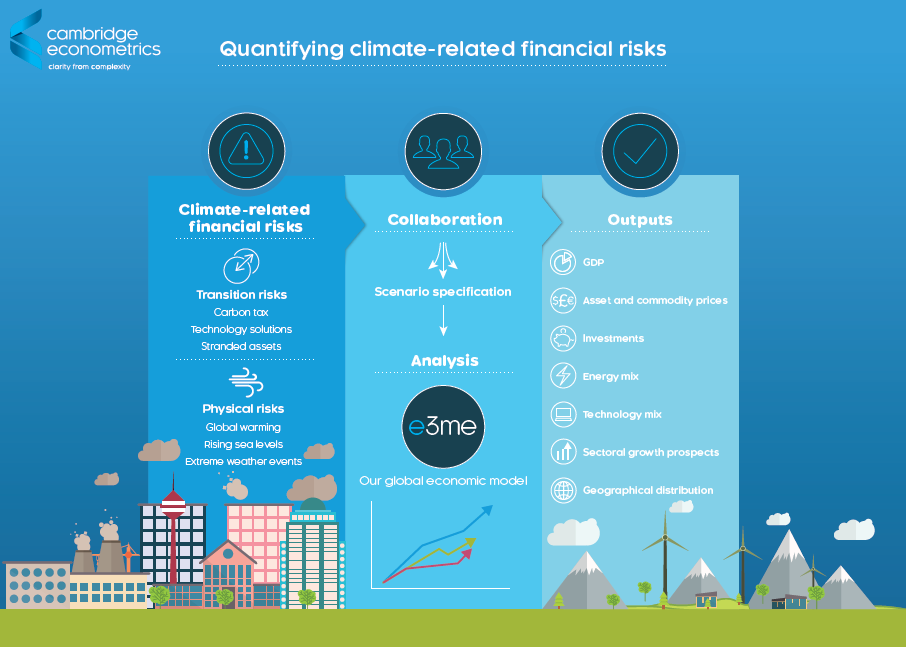

We help financial institutions plan for the future and implement the recommendations of the Task-force on Climate-related Financial Disclosures (TCFD) using our in-house macroeconomic model:

We provide you with:

- national and global analysis of the transitional impacts associated with different global emissions and temperature pathways

- a range of indicators, providing scenarios to measure the impacts of alternative emissions pathways on:

- GDP and employment

- sectoral output and value added

- sectoral investment

- inflation and sectoral prices

- results at a high level of granularity (at a national and sectoral level)

- short and long-run analysis (annual results up to 2100)

We can provide the level of analysis and outputs most appropriate to your needs, for example:

- results for 1.5˚C, 2˚C, 3˚C and 4˚C scenarios (by region and sectors of interest) in a range of (e.g. spreadsheet) formats

- analytical descriptions of how different sectors and regions are expected to be affected by the low-carbon transition and/or climate damages.

Context

Climate change is one of the most significant economic challenges that humanity has ever faced.

If no further action is taken to mitigate climate change, global temperature rise is expected to reach 4˚C above pre-industrial levels by the end of this century. This is likely to have a catastrophic impact on life on Earth and lead to long-lasting, negative impacts on the global economy.

To limit temperature change to ‘well below 2 degrees’ (in line with the Paris Climate Accord), substantial low-carbon investment will be required over the coming decades. With this will come opportunities for ‘green growth’ as well as the risk of financial instability from stranded assets.

Informed investor decision-making and transparency on climate-related risks is therefore essential to promoting a smooth market transition to a low-carbon economy.

In 2017, the Task-force on Climate related Financial Disclosures (TCFD) recommended long-term forward-looking scenario analysis to better understand the likely impacts of climate change and related policy on investment portfolios. The E3ME macroeconomic model, which has been developed by Cambridge Econometrics over the past 20 years, is designed for exactly this type of analysis.

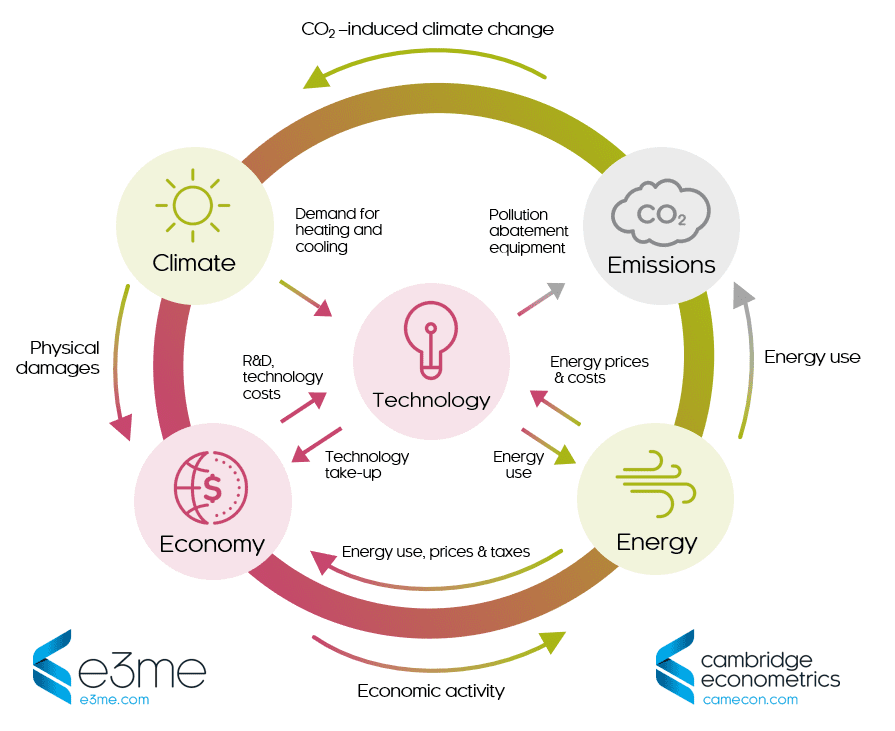

E3ME modelling

E3ME is recognised globally as one of the leading models for comprehensive economic modelling of policy and technology scenarios.

The key strengths of E3ME for modelling scenarios consistent with the TCFD include:

- complete representation of the economy, energy systems and the environment, and the inter-linkages between each of these components

- a high level of granularity, including coverage of 59 nation states/regions and up to 70 distinct economic sectors

- explicit representation of the drivers of technology take up and the interactions between energy policy and technology

- integrated fossil fuel supply curves, to model stranded fossil fuel resource at a national or regional level

Recent applications:

- Assessing the economic and environmental impacts of 1.5˚C climate scenarios for the UK’s Natural Environment Research Council and European Commission

- Modelling the economic and environmental impacts of Global Renewables Targets for the International Renewable Energy Agency (IRENA)

- Modelling policies that promote economic growth and reduce the risks of climate change for the 2018 New Climate Economy report

E3ME was also recently used for the analysis underpinning a paper published in Nature Climate Change: Macroeconomic impact of stranded fossil fuel assets, which was co-authored by senior staff at Cambridge Econometrics.

The full model manual and a list of peer-reviewed publications in which it has been applied is available from www.E3ME.com.

Find our more

To explore how we can help you understand potential challenges for a national or global economy under alternative emissions and global temperature pathways please contact: