E3ME considered among top five macroeconomic models for integrating climate risk into the President’s Budget

Cambridge Econometrics is delighted to note that a recent White Paper by the White House’s Office of Management and Budget (OMB) and the Council of Economic Advisers (CEA) featured our global macroeconomic model E3ME as a potential methodology for integrating climate risk into the macroeconomic forecasting for the President’s Budget.

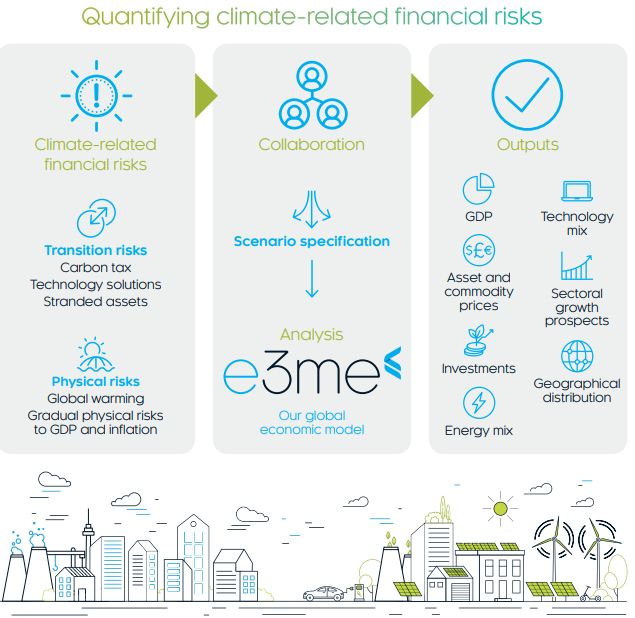

Our globally recognized macroeconomic model E3ME provides rigorous evidence-based insights for our Sustainable Investment service which helps governments, central banks and financial institutions to assess climate-related risk and make informed sustainable portfolio and policy decisions.

E3ME was one of five models assessed, and the only consultancy-based model to be considered. The E3ME model supports understanding of risks of climate change by simulating investment effects and dynamic adjustments to changes in energy prices, taxes and other policy levers. For the US, the model can be supplemented by our E3-US model to understand state level impacts of policies.

Four main qualities of E3ME and E3-US were highlighted by the OMB and CEA:

- E3ME estimates economic activity, energy supply and demand, emissions, and trades in 71 regions worldwide. This includes assessing the U.S. as a country, across 43 industries.

- The model uses top-down empirically estimated econometric equations to simulate the behavior of sectors and households.

- Demand-driven: the model can endogenously model voluntary and involuntary unemployment. E3ME allows for unused labor and capital resources to be deployed under certain policy and economic conditions.

- State-level detail with E3-US: the 50-state E3-US model shares many of the features of E3ME, covering the interdependencies between the economy, energy and environment systems.

Dan Hodge, Executive Vice President of Cambridge Econometrics Inc., comments,

We are thrilled to be recognized alongside such high caliber models as a potential tool for understanding the physical and transitional risks of climate change for the President’s Budget. Cambridge Econometrics is bringing rigorous economic analysis tools to the conversation about energy and climate policy, helping our clients understand the impacts of their policy and investment decisions.

We look forward to continuing to apply our E3ME and E3-US models on critical energy and decarbonization economic policy projects at the national and state-levels.

Phil Summerton, Chief Executive Officer of Cambridge Econometrics Ltd., comments,

For over 25 years our global macroeconomic model E3ME has served a range of Governments, businesses and NGOs on key energy, economic and environmental policy issues.

This recognition by the White House is a significant milestone in the history of E3ME, for our team of consultants, and our ongoing contribution to evidence-based decision-making across the private and public sectors worldwide.

Cambridge Econometrics has a dedicated 50-state E3-US model which supports understanding of risks of climate change by simulating investment effects and dynamic adjustments to changes in energy prices, taxes and other policy levers.

Stay in touch

Sign up to our newsletter for quarterly news, insights and team updates.